Navigate Your Online Tax Obligation Return in Australia: Crucial Resources and Tips

Browsing the on the internet tax obligation return procedure in Australia requires a clear understanding of your commitments and the resources available to enhance the experience. Vital documents, such as your Tax Obligation File Number and revenue statements, have to be carefully prepared. Picking a suitable online system can substantially impact the efficiency of your declaring process.

Recognizing Tax Responsibilities

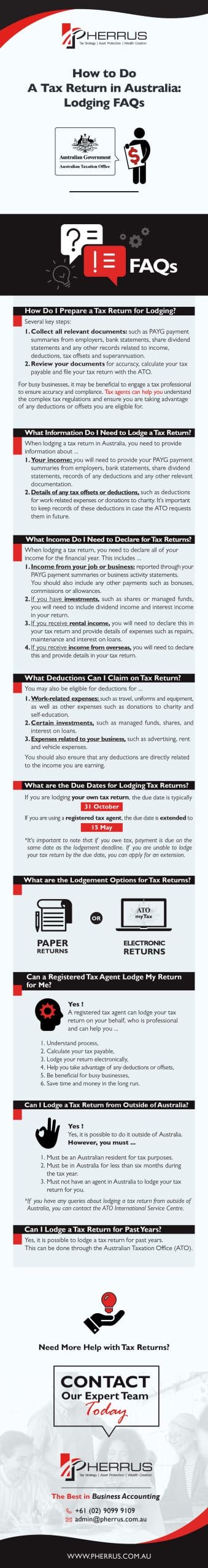

People have to report their income accurately, which includes wages, rental income, and investment profits, and pay taxes appropriately. Citizens need to recognize the distinction in between non-taxable and taxable earnings to ensure compliance and enhance tax obligation results.

For businesses, tax obligations incorporate numerous aspects, consisting of the Item and Services Tax (GST), company tax, and payroll tax obligation. It is crucial for organizations to sign up for an Australian Company Number (ABN) and, if relevant, GST enrollment. These obligations demand careful record-keeping and timely entries of income tax return.

Additionally, taxpayers need to be familiar with available reductions and offsets that can reduce their tax obligation concern. Consulting from tax specialists can offer beneficial insights right into enhancing tax obligation settings while guaranteeing compliance with the legislation. Generally, a detailed understanding of tax responsibilities is important for efficient monetary preparation and to prevent penalties connected with non-compliance in Australia.

Essential Papers to Prepare

In addition, compile any kind of pertinent financial institution declarations that show rate of interest revenue, along with dividend statements if you hold shares. If you have various other sources of earnings, such as rental buildings or freelance job, ensure you have documents of these profits and any kind of connected costs.

Do not neglect to include reductions for which you might be eligible. This could entail receipts for work-related costs, education prices, or charitable contributions. Take into consideration any kind of personal health and wellness insurance declarations, as these can influence your tax obligations. By collecting these crucial records beforehand, you will streamline your on-line tax obligation return process, minimize mistakes, and optimize prospective refunds.

Picking the Right Online Platform

As you prepare to submit your on the internet tax obligation return in Australia, picking the appropriate system is essential to make sure accuracy and simplicity of use. An uncomplicated, user-friendly layout can significantly enhance your experience, making it much easier to browse intricate tax obligation types.

Next, analyze the platform's compatibility with your financial circumstance. Some services cater especially to individuals with straightforward tax obligation returns, while others supply detailed assistance for extra intricate situations, such as self-employment or financial investment revenue. Look for systems that provide real-time mistake checking and advice, aiding to decrease blunders and making certain conformity with Australian tax obligation legislations.

One more important aspect to consider is the degree of client support available. Dependable platforms need Read Full Article to give access to support via phone, chat, or e-mail, specifically throughout top declaring durations. Additionally, study individual reviews and rankings to gauge the total contentment and dependability of the platform.

Tips for a Smooth Declaring Process

If you follow a couple of key ideas to guarantee performance and precision,Submitting your on the internet tax obligation return can be a straightforward procedure - online tax return in Australia. Collect all essential files prior to beginning. This includes your revenue declarations, receipts for deductions, and any various other relevant documentation. Having everything available decreases mistakes and interruptions.

Following, take benefit of the pre-filling feature provided by lots of on-line systems. This can conserve time and reduce the chance of errors by immediately inhabiting your return with details from previous years and data provided by your employer and banks.

In addition, ascertain all access for precision. online tax return in Australia. Blunders can lead to delayed refunds or issues with the Australian Taxation Workplace (ATO) Ensure that your personal information, revenue numbers, and reductions are correct

Be mindful of deadlines. If you owe taxes, filing early not just lowers stress and anxiety yet likewise enables for much better planning. If you have unpredictabilities or inquiries, seek advice from the assistance areas of your selected platform or look for expert advice. By adhering to these ideas, you can navigate the on-line income tax return process efficiently and confidently.

Resources for Assistance and Assistance

Navigating the intricacies of online tax obligation returns can in some cases be complicated, but a range of resources for assistance and assistance are easily offered to assist taxpayers. The Australian Taxes Office (ATO) is the key source of details, providing comprehensive guides on its site, including Frequently asked questions, educational video clips, and live chat choices for real-time aid.

In Addition, the ATO's phone support line is offered for those that prefer direct interaction. online tax return in Australia. Tax obligation specialists, such as registered tax representatives, can also offer personalized assistance and make certain compliance with current tax policies

Verdict

To conclude, properly browsing the online tax obligation return process in Australia requires an extensive understanding of tax responsibilities, precise prep work of vital documents, and mindful choice of a suitable online system. Adhering to useful tips can improve the declaring experience, while offered resources use important assistance. By approaching the procedure with diligence and interest to information, taxpayers can ensure compliance and make best use of prospective advantages, inevitably adding to a much more effective find out here now and efficient tax obligation return outcome.

As you prepare to file your online tax obligation return in Australia, choosing the ideal system is crucial to ensure accuracy and ease of usage.In conclusion, successfully browsing the on-line tax obligation return process in Australia needs a comprehensive understanding of tax responsibilities, precise prep work of vital papers, and cautious choice of an ideal online platform.

Comments on “What You Required to Know Prior To You Submit Your Online Tax Return in Australia”